The Project

The purpose of our study was to discover how young adults manage their day to day finances, along with how these choices can affect them emotionally. The reason we chose this topic is that we felt it hit close to home with all members being in their early to mid-twenties, realizing we all have different views on spending and saving.

Category: School Project

Duration: 1 month

Team: Christopher Browne, Omar Fakhry, Trisha Naik, Ellixs Tulagan

Tools:Google Docs, Journals, Sticky Notes

My Role

- Conducted Screener Interviews with Participants.

- Interviewed Participants every 2 days.

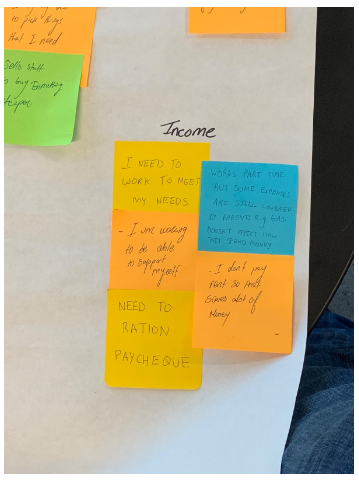

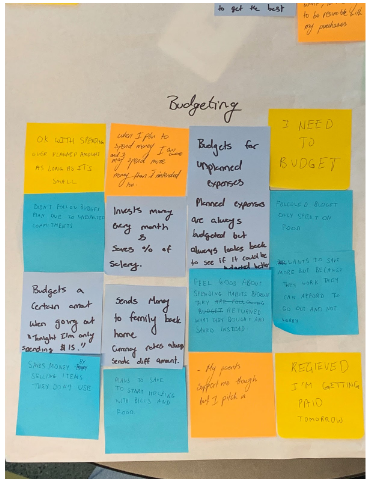

- Created affinity diagrams based on data gathered from the diary study.

- Analyzed findings from the study with my team members and produced a report of our learning.

How It All Began

The team then decided to use a Diary Study to help us to collect information with Humber students in their twenties, who became the main focus of our study. So why a Diary Study? A Diary Study would help guide our participants to think about their environments in different ways, helping us discover both the challenges and opportunities our participants face.

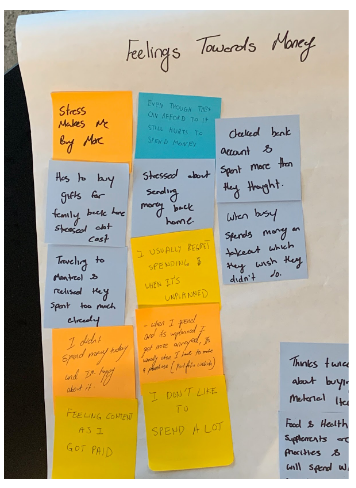

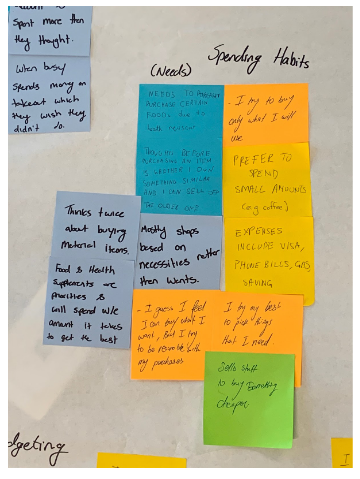

Our Findings

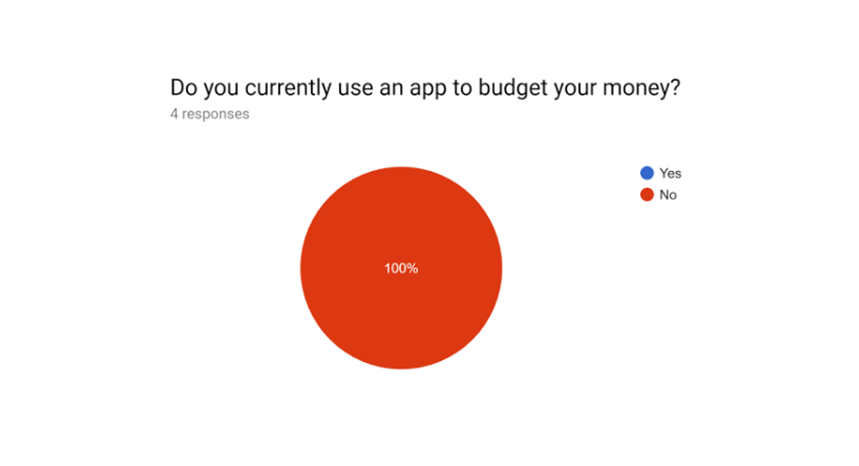

From our screener questions, we learned that not one of our participants currently uses budgeting apps to keep track of their finances, this was especially surprising since we live in such a technology-reliant society.

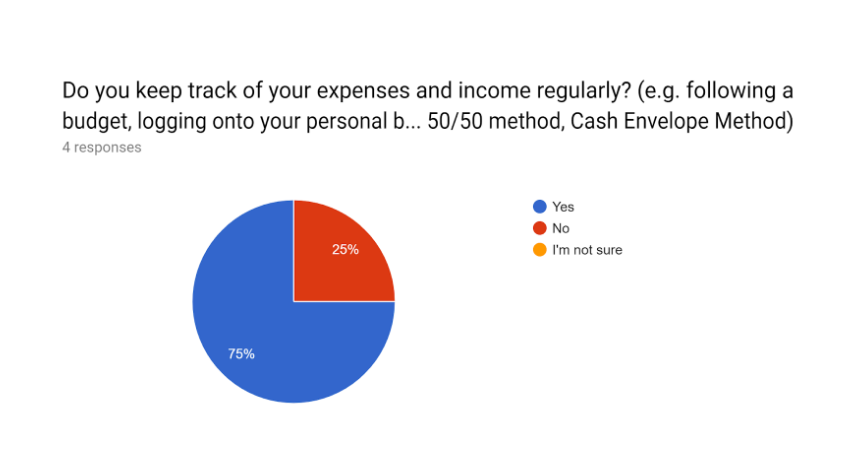

From there, we also noticed that even though they don't use any kind of app to keep track of their finances, 75% of our participants still track their spending and saving regularly. Showing they still have an interest in their finances but, each has their way of going about it

Things to take away

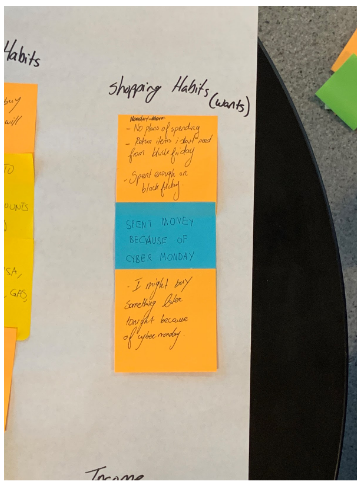

- Every participant's situation is different the challenges international students may face a domestic student might not and vice versa.

- In the end, we came to realize our participant’s spending habits differed based on their situations and circumstances.

- Our participants wanted to save but sometimes a lack of motivation or unexpected commitments got in the way.

- They do understand the importance of budgeting and are willing to develop better habits concerning spending and saving in the future.